This blog was published on 21 September 2008 and may be out of date.

虽然写blog记事的习惯已经持续了很久,不过从有独立域名,独立空间开始,也就一年的时间。中间还有三个月因为假期,blog基本处于关闭状态。

准确的说应该是一年多一点,这个blog是从9月3日开始的,不过访客统计是从一年前的9月20日开始的,就这样算吧,方便点。

至于流量,独立访客一年也就11,000多一点,还比不上别人一天的流量。当然,我的目的并不是流量,所以也不是很在意。就算没有人看,自己经营一个blog也是一件很有意思的事情,享受把想法写出来的乐趣,顺便在维护汇总学习网络知识——我从未学过PHP,CSS之类的东西,不过,现在也不算学过,都是照模样画葫芦。

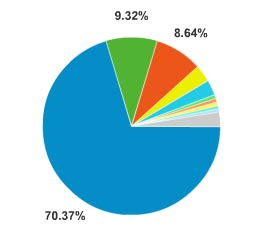

不过有点尴尬的是,虽然blog标题中有新西兰三个字,但真正来自新西兰的访客只有10%不到——我从不做宣传,所以大部分流量(60%+)来自搜索引擎。

更多的资料在本文最后。

一年中最深的体会是,中文网络的生存环境实在是极其恶劣。我虽然不准备拿blog赚钱,但我完全能够理解那些创业站长们的难处。站长们的原创虽然吸引访客,但也吸引抄袭者,而这群抄袭者常常是各大门户网站的网络民工,也就是所谓的“编辑”——自己原创内容的价值不仅要先被搜索引擎搜刮一次,再让门户网站抄一遍,站长创业的努力全给别人做了嫁衣。

我自己也非常头疼这个问题,稍微认真写出的blog,过不了多久就会出现在各大门户网站——只要是你能说出名字的大门户,上面几乎都有我的内容(就算我写得再烂)。他们把作者名删除,正文里的內链也不放过,我实在是不明白,这样做对抄袭者有什么好处,留下作者名又不会少赚几毛钱。

当然,被抄不意味着就不应该坚持原创。写得再烂,那至少是自己写的——如果一个blog里的东西都和你没关系,那还是你的blog吗?

对于那些创业者,我觉得有两条路可以走,要么诉诸法律警告那些抄袭者,要么制造出别人无法抄袭的东西。前者费时费力,只有后者才是正道。我脑袋里能想出来的例子是那个百万网——只有首创者能够获得价值,而其他上百家模仿者都无法成功。

没有创意的话,就写他们不敢抄的东西……

—–

扯远了,下面是这一年来一些有趣的统计资料。我自己的访问已经被排除在统计数据外。

当然,先惊叹一下Google Analytics的强大。

- 访客来源前3的国家:中国,新西兰,美国

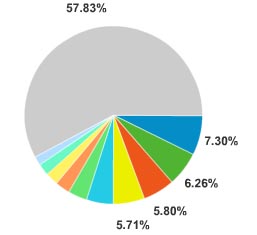

- 访客来源前3的城市:北京,奥克兰,成都(图上最大57.83%那一块是其他城市总和)